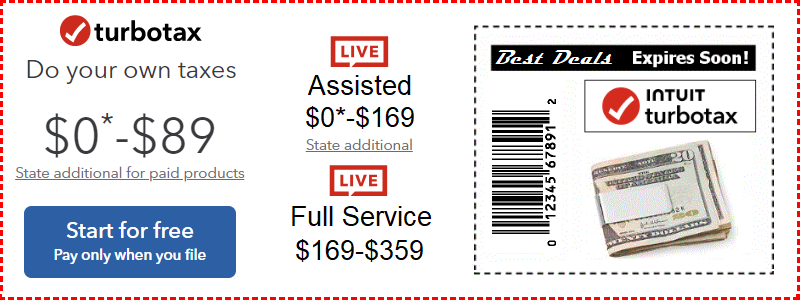

TurboTax 2024 Tax Filing Options

Intuit TurboTax 2024 Review:

TurboTax from Intuit, Inc. stands above the rest as the market leader for tax software sales. Our review is on a Microsoft Windows edition of TurboTax 2024 for this article, it's also available for Macs.

H&R Block is a name associated for years with face-to-face income tax preparation, but this company has also become aggressive in the software arena with it's H&R Block Software line.

Why buy a PC based tax preparation software package?

Tax software is a pretty accurate way of preparing your return and insuring you get every tax break along with the least mistakes on you return. With TurboTax you have software that searches out every deduction all while making sure entries are accurate. These programs also notify you of entries that could cause and audit to be filed against you, giving you the opportunity to make changes.

Tax laws change change from year to year and there are only three types of tax professionals

who can represent you before the IRS. With a signed power of attorney, a CPA, Attorney, or Enrolled

Agent can conduct all audit related activities for you s your IRS representative. With TurboTax,

a legal representative one of the benefits in the case of an audit that comes with your software

package.

TurboTax 2024 Online Tax Filing Option

TurboTax also offers a free simple return tax return program that generates and electronically files your return at no cost. For example, “Free File” is a plan developed years ago between the IRS and a number of participating tax filing companies to allow certain taxpayers who meet their requirements to prepare and e-file their federal tax return for free. Originally, only very simple returns on Form 1040EZ were allowed to be file with this program, but that has been greatly expanded to accept more complex returns and the income cap has been raised as well.

Other free software editions are available as well, such as the TurboTax Free Edition for simple tax returns only "not all taxpayers qualify" that allow basic 1040ez filing for anyone that has a simple tax return without special needs or forms. You can efile your federal tax return online directly with the IRS with this package for free as well. The TurboTax online editions vary from the free edition to TurboTax Home and Business for filing both returns.

TurboTax 2024 Desktop Software Downloads and CD's.

Another

alternative is the TurboTax Desktop Software Editions. These paid programs tend to offer more

guidance on matters like deductions and depreciation that could help lower your tax bill or

increase your refund. With the use of this software it is generally much easier to prepare and

file your return that any other self prepared method for filing.

Another

alternative is the TurboTax Desktop Software Editions. These paid programs tend to offer more

guidance on matters like deductions and depreciation that could help lower your tax bill or

increase your refund. With the use of this software it is generally much easier to prepare and

file your return that any other self prepared method for filing.

Getting Started with TurboTax 2024

To get started preparing a return it's the same regardless of whether you’re preparing it by hand, online, with paid software, or by hiring a tax preparation professional. You need to gather up all the documents and receipts required for calculations on your tax return.

TurboTax offers four paid editions, Basic, Deluxe, Premier, Premier and Business, and the Business Edition. Unlike the Free Federal Online Edition, the paid editions come with step-by-step guides to help you complete the process under fully guided support. More forms are included in the paid editions as well, though filing a state return costs extra for each state return you need to file.

The Home & Business Edition is oriented towards those who run a small business. Generally this means someone who has self-employment income, verses a taxpayer who has a business that requires a partnership or corporation return, in which case the Business Edition is the right choice.

With TurboTax 2024 the step-by-step guides are geared to help you maximize various types of deductions (personal, home office, small business, and industry-specific) as well as registering depreciation on those items that you can write off.

Installing TurboTax 2024

Installation of TurboTax software starts with checking for updates. New updates happen frequently during tax season as the IRS makes changes in the tax laws. Keeping up with these changes is easy with these updates. Once that's completed you can download the state software if you are required to file a state return.

Using TurboTax to Prepare Your Return

As you start preparing your return you are presented with a screen asking if various circumstances have changed over the last year. Did you get married, change jobs, have educational or medical expenses, there’s a check box next to each category as you choose.